What Is The Daycare Tax Form Called

Daycare Provider Employees When you provide daycare services as an employee filing your tax forms is relatively straightforward. These expenses qualify for the child care tax credit IRS Form 2441 formally known as the Child and Dependent Care Expenses tax credit and if your family has never taken advantage of this tax break it could be a game-changer the next time you file your taxes.

Explore Our Sample Of Child Care Expense Receipt Template Child Care Services Receipt Template Childcare

Many child care centers are organized as corporations Form 1120 S corporations Form 1120S or partnerships Form 1065.

What is the daycare tax form called. For Tax Years 2018-2025 the Child Tax Credit can be worth as much as 2000 per qualified child depending on your total income. This will determine your taxes for childcare. Daycare Tax Statement Forms You can apply for an EIN number which is an Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040-SR or 1040-NR and meet all the tests in Tests you must meet. Starting in the 2019 tax year Ontario families will be eligible for a new refundable tax credit based on their annual household income. For 2020 this credit can be worth up to 20 to 35 of up to 3000 of.

Also if your income minus expenses from self-employment is more than 400 you must file Schedule SE. Arent filing separate returns if youre married. If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you can claim a tax credit.

This credit referred to as CARE child care access and relief from expenses will be applied on a sliding scale to family households making up to 150K in combined taxable income. This is not required for daycare providers but if you have an issue with giving out your social security number then consider this an option. If your return isnt open youll need to sign in and click Take me to my return.

This type of child care is usually provided in separate facilities apart from the owners residence. Have earned income through an. Information about Form 2441 Child and Dependent Care Expenses including recent updates related forms and instructions on how to file.

Your employer will report your annual earnings and the amount of. This form is used for certification of the Dependent Care Providers name address and taxpayer identification number to report on Form 2441 Child and Dependent Care Expenses. Open continue your return in TurboTax Online.

There may be one or. The IRS usually considers childcare providers as independent contractors. Go to wwwirsgovForm2441 for instructions and the latest information.

Entering this information in TurboTax generates Form 2441 which is filed with your tax return if you qualify for the Child and Dependent Care Credit. Form 8962 Premium Tax Credit If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return. The IRS allows you to deduct certain childcare expenses on your tax return.

To enter your child care expenses on Form 2441. Since independent contractors are self-employed you should report your income on Schedule C. There may be more than one facility operated by a corporation or partnership.

Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit. File taxes using Form 1040 or 1040NR. Information about Form W-10 Dependent Care Providers Identification and Certification including recent updates related forms and instructions on how to file.

Form 2441 Child and Dependent Care Expenses is an Internal Revenue Service IRS form used to report child and dependent care expenses on your tax return in order to claim a tax credit for those. You qualify for the child care tax credit as long as you. Form 2441 Department of the Treasury Internal Revenue Service 99 Child and Dependent Care Expenses Attach to Form 1040 1040-SR or 1040-NR.

Youll use this form to reconcile to find out if you used more.

/2441-b1862b33c9114ea490a73925cb0252d7.jpg)

Form 2441 Child And Dependent Care Expenses Definition

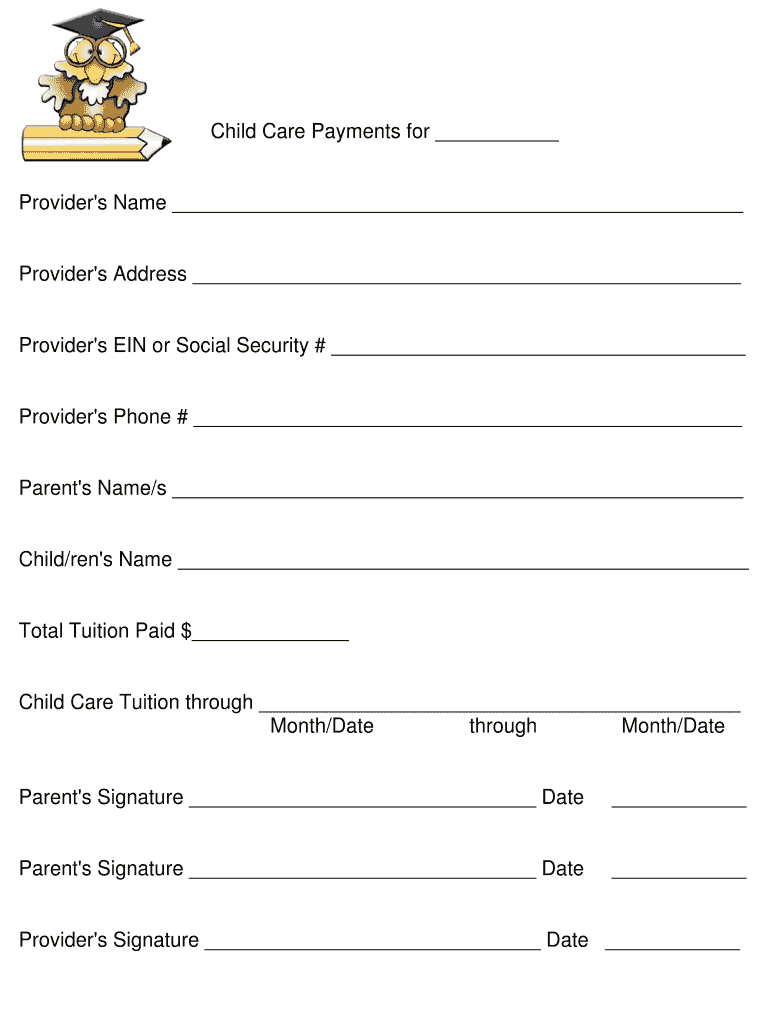

A Daycare Tax Statement Must Be Given To Parents At The End Of The Year A Few Choices Of Forms To Print And Use Immed Daycare Forms Starting A Daycare Daycare

Daycare Attendance Record Form Daycare Signs Daycare Forms Sign Out Sheet

Free Boo Boo Report Sheet For Daycares And Teachers Daycare Forms Starting A Daycare Infant Daycare

Daycare Tax Form For Parents Fill Online Printable Fillable Blank Pdffiller

Free Daycare Contract Forms Daycare Contract Forms Starting A Daycare Daycare Contract

Record Keeping Practices Family Child Care Childcare Business Childcare

Printable Daycare Expense Template Small Business Expenses Spreadsheet Business Spreadsheet Template Business

Pin By Britta On Daycare Ideas Daycare Forms Starting A Daycare Daycare

Business Mileage Tracking Log Business Plan Template Free Business Plan Template Daycare Business Plan

Finding Child Care Ein Number 4 Ways To Do It Applications In United States Application Gov

/2441-b1862b33c9114ea490a73925cb0252d7.jpg)

Form 2441 Child And Dependent Care Expenses Definition

Pdf Doc Free Premium Templates Daycare Forms Receipt Template Daycare Contract

Pdf Doc Free Premium Templates Receipt Template Daycare Forms Invoice Template Word

Daycare Attendance Record Form Daycare Signs Daycare Printables Daycare Forms

Tax Form Child Care Here S Why You Should Attend Tax Form Child Care Family Child Care Starting A Daycare End Of Year

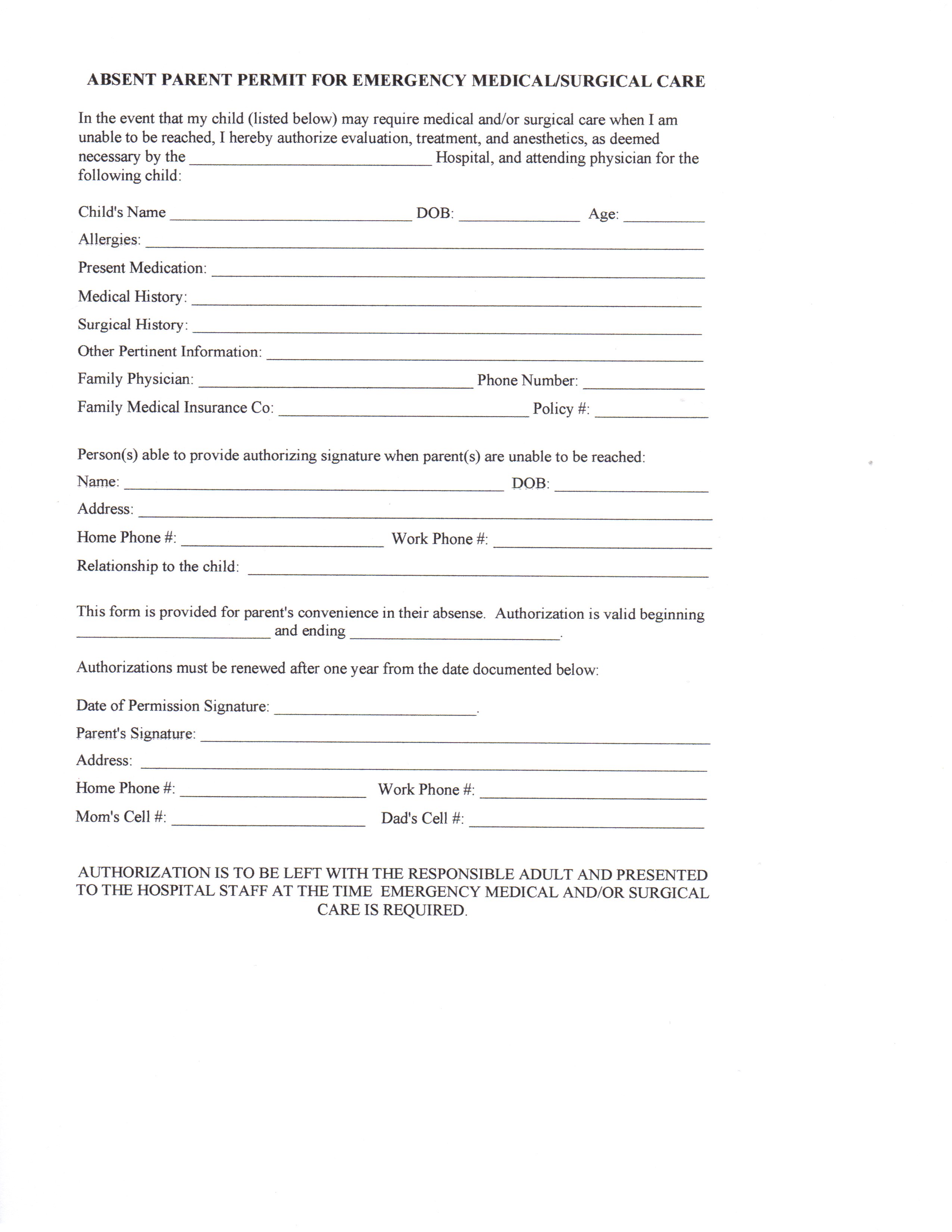

Medical Release Form For Babysitter Awesome Free Minor Child Medical Consent Form Word Peterainsworth Free Child Care Daycare Forms Starting A Daycare

Tax Form 2441 Instructions Info On Child Dependent Care Expenses